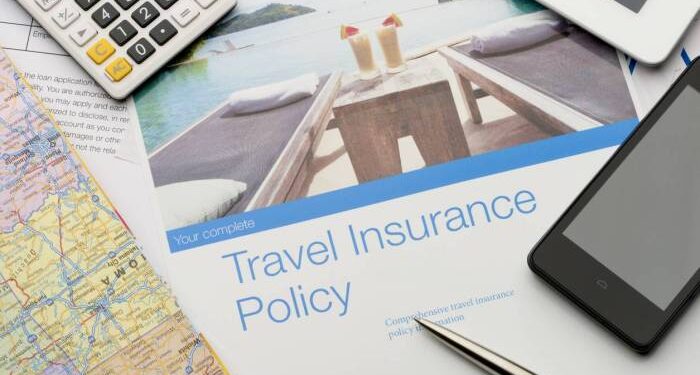

Trip Insurance for Cruises: Avoid These Common Mistakes sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

The content of the second paragraph that provides descriptive and clear information about the topic

Common Mistakes in Choosing Trip Insurance

When it comes to cruises, trip insurance is essential to protect yourself from unexpected events that can disrupt your travel plans. However, many people make mistakes when selecting trip insurance for cruises, which can have significant consequences during their trip.

Not Reading the Fine Print

One of the most common mistakes people make when choosing trip insurance for cruises is not reading the fine print of the policy. This can lead to misunderstandings about coverage limits, exclusions, and claim procedures, leaving travelers vulnerable in case of emergencies.

Underestimating Coverage Needs

Another common mistake is underestimating their coverage needs. Some travelers opt for basic trip insurance without considering factors like pre-existing medical conditions, trip cancellations, or lost luggage. This can result in inadequate coverage when faced with unexpected situations.

Delaying Purchase of Insurance

Delaying the purchase of trip insurance is also a mistake that travelers often make. Waiting until the last minute to buy insurance can leave them unprotected against unforeseen events that may occur before the trip, such as illness or severe weather conditions.

Choosing the Cheapest Option

Opting for the cheapest trip insurance without considering the coverage provided is another common mistake. While cost is important, it is crucial to ensure that the policy offers adequate protection for your specific needs to avoid being underinsured during your cruise.

Understanding Coverage Options

When it comes to trip insurance for cruises, understanding the coverage options available is crucial to ensure you have the right protection in place for your trip.

Types of Coverage Options

- Medical Coverage: Provides coverage for medical emergencies and expenses while on your cruise.

- Cancellation Coverage: Protects you in case you need to cancel your trip due to unforeseen circumstances.

- Baggage Loss Coverage: Covers the cost of lost or damaged baggage during your cruise.

- Travel Delay Coverage: Reimburses you for additional expenses incurred due to travel delays.

Key Factors to Consider

- Destination: Consider the location of your cruise and whether you may need specific coverage for that region.

- Trip Cost: Ensure the coverage limit aligns with the total cost of your cruise to avoid being underinsured.

- Pre-Existing Conditions: Check if the policy covers pre-existing medical conditions to avoid any issues during your trip.

Basic Coverage vs. Comprehensive Coverage

Basic coverage typically includes essential benefits such as trip cancellation and emergency medical coverage, while comprehensive coverage offers additional benefits like baggage loss and travel delay coverage.

It's important to assess your individual needs and the potential risks involved in your cruise to determine whether basic or comprehensive coverage is more suitable for you.

Reading the Fine Print

When it comes to trip insurance for cruises, one of the most crucial steps is reading the fine print of the policy. This detailed section contains important information about coverage, exclusions, and limitations that can impact your trip.

Significance of Reading Fine Print

Understanding the fine print is essential to ensure that you have comprehensive coverage for your cruise trip. By carefully reviewing this section, you can avoid surprises and misunderstandings in case of emergencies or unexpected events

- Check for specific coverage details: Look for information on trip cancellation, trip interruption, emergency medical expenses, baggage loss, and other key aspects of the policy.

- Review exclusions and limitations: Make sure to understand what is not covered by the insurance policy, such as pre-existing medical conditions, high-risk activities, or certain destinations.

- Verify claim procedures: Familiarize yourself with the steps required to file a claim in case of an incident during your cruise. Understanding the process can help expedite your claim.

Tips for Comprehensive Coverage

Here are some tips on what to look for in the fine print to ensure you have adequate coverage for your cruise:

- Pay attention to coverage limits: Check the maximum amounts the insurance will pay for different categories, such as medical expenses or baggage loss.

- Understand the definition of terms: Clarify any ambiguous terms or jargon used in the policy to avoid misinterpretation when making a claim.

- Look for optional add-ons: Explore additional coverage options that may be available, such as cancel for any reason coverage or adventure sports coverage, to tailor the policy to your needs.

Real-Life Scenarios

Imagine booking a cruise and falling ill just before your departure date. If you had carefully read the fine print of your trip insurance policy, you would have known whether your medical condition was covered for trip cancellation or medical expenses.

In another scenario, if your baggage gets lost during a cruise and you were unaware of the coverage limits Artikeld in the fine print, you might be surprised by the reimbursement amount provided by the insurance company.

Pre-Existing Medical Conditions

When it comes to trip insurance for cruises, pre-existing medical conditions can have a significant impact on coverage and claims. It's crucial for travelers to understand how these conditions can affect their insurance and what steps they can take to navigate this aspect of coverage.

Implications of Pre-Existing Medical Conditions

- Pre-existing medical conditions may not be covered by standard trip insurance policies, unless specifically stated in the policy.

- Travelers with pre-existing conditions may need to purchase a separate rider or upgrade their policy to ensure coverage for any related issues during their cruise.

- Failure to disclose pre-existing conditions accurately during the application process can result in denied claims or even policy cancellation.

Guidance for Travelers with Pre-Existing Conditions

- Review policy details carefully to understand coverage for pre-existing conditions, including any exclusions or limitations.

- Consider purchasing a policy with a pre-existing conditions waiver, which can provide coverage for related issues during the trip.

- Consult with a travel insurance agent to discuss your specific medical history and find the best policy for your needs.

Examples of How Pre-Existing Conditions Can Affect Claims

- If a traveler with a pre-existing heart condition experiences a medical emergency during the cruise, their insurance claim may be denied if the condition was not disclosed in the application.

- A traveler on a cruise who has diabetes may require medical treatment on board, but without a pre-existing conditions waiver, they may have to pay out of pocket for any related expenses.

- In cases where a traveler needs to cancel their cruise due to a pre-existing condition flare-up, having the appropriate coverage in place can help them recoup their non-refundable expenses.

Final Conclusion

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Questions and Answers

What factors should I consider when choosing trip insurance for a cruise?

Consider factors like coverage options, pre-existing conditions, and reading the fine print carefully to ensure you choose the right policy for your cruise.

How do pre-existing medical conditions impact trip insurance for cruises?

Pre-existing conditions can affect coverage and claims, so it's important to disclose them when purchasing insurance and understand how they might impact your policy.

Why is reading the fine print of a trip insurance policy important?

Reading the fine print ensures you understand what is covered, any exclusions, and the terms of your policy, helping you avoid surprises during your cruise.